What Is Financial Inclusion And How Will It Change The Banking Scenario In Coming Years?

Getting the unbanked population in mainstream banking scenario had been proven to be a dainty...

Read More

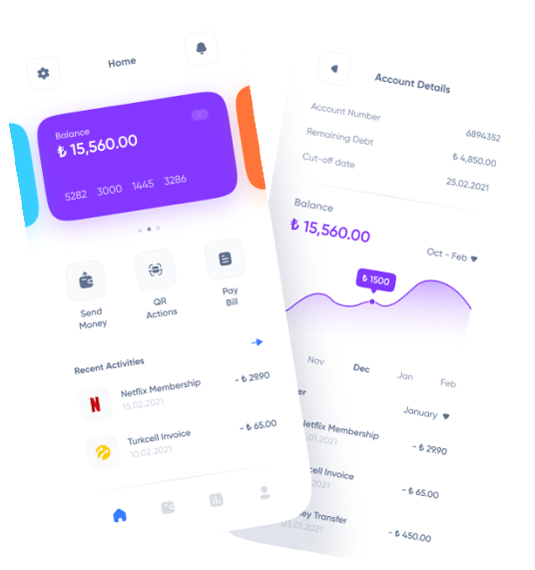

Finlife Tech (India) Pvt. Ltd. is revolutionizing the way financial access is

delivered to under-served segments of the Indian retail economy, through specialized

financing and technology products that empower individuals, entrepreneurs and small and

medium businesses (SMBs) to progress without obstacles.

With technology first approach, Finlife India is a holistic platform empowering the entire

rural and urban unbanked populace and landscape providing financial inclusion.

We leverage a perfect mix of processes, people and technology to deliver measurable products to our clients, keeping clients objective in mind. Since our inception, Finlife Tech (India) Private Limited has made significant strides in advancing financial inclusion in India through our service offerings.

Our AePS service enables customer to avail hassle free and biometric authenticated banking services through their Adhaar linked bank accounts.

All time and highly efficient Micro ATM service availability & Uptime. We intelligently deploy this solution to enable connectivity and business continuity.

We offer various utility recharge solutions via our advance portal to both retailers and distributors.

We provide adhaar payments services to our Banking associates and retail partners to take payments from customer easily.

Pay bills across locations using One single Dashboard and meet demand of innovative billing and payment options.

We Provide this services to fullfill the money transfer needs of the unbanked population through its widespread network associates.

We offer a unified platform for all services related to the application of Pan Card and other Pan Card services related in minimal turn around time.

Easy loan facility to accommodate every section of society with easy repayment terms, flexibility and access to credit as per requirement, to ensure your peace of mind.

We offer a comprehensive range of Insurance & Investment solutions such as life and non life insurance, mutual funds, SIPs etc.

We offer Software development services and dedicated teams for a variety of businesses like fintech start-ups, businesses and big corporate.

To keep up with the changing trends of Market and customer needs.

To provide hassle free experience to our customer

Keeping all transaction safe and secure at each level

Lightning fast services allows us to stay ahead of the curve

Empowering India with our unique Fintech Solutions to make India Financially sustainable one step at a time

Getting the unbanked population in mainstream banking scenario had been proven to be a dainty...

Read MoreDigital Banking in India is expected to grow with a CAGR of 23.1% from 2022 to 2030. NBFC growth is also estimated to hit $5 trillion in 2024.

Read MoreParting from traditional brick-and-mortar banking, there is a paradigm shift in how banking is done. Today, banking is also about value addition to...

Read More